Forza Petroleum 2020 Financial

and Operational Results

18 March 2021

Calgary, Alberta, March 18, 2021

Significant decrease in liabilities and reduced general and administration costs position Forza Petroleum to leverage increasing oil prices to strengthen financial position and fund an ambitious 2021 work program to increase production

Forza Petroleum Limited (“Forza Petroleum” or the “Corporation”) today announces its financial and operational results for the year ended December 31, 2020. All dollar amounts set forth in this news release are in United States dollars.

2020 Financial Highlights:

- Total revenues of $82.0 million on working interest sales of 2,512,100 barrels of oil (“bbl”) and an average realised sales price of $28.23/bbl for 2020

- 46% annual decrease in revenues versus 2019 primarily the result of a 42% decrease in average realised sales price

- Except for the $22 million remaining outstanding balance for oil sales during the months of November and December 2019 and January and February 2020, the Corporation has received full payment in accordance with production sharing contract entitlements for all oil sale deliveries into the Kurdistan Oil Export Pipeline through January 2021

- Monthly payments are now being made by the Kurdistan Region of Iraq Ministry of Natural Resources against the $22 million in past due receivables. The monthly additional payment is equal to gross sales barrels from the Hawler license area for the applicable month multiplied by 50% of the amount by which the average dated Brent price for the month exceeds $50/bbl

- Operating expenses of $24.8 million ($9.87/bbl) for the year as a whole, reducing to $8.97/bbl for Q4 2020

- Annual operating expenses per barrel down 5% versus 2019

- Operating expenses per barrel in Q4 2020 down 8% versus Q4 2019

- Significant reduction in head office headcount from mid-2020 contributed to general and administration cost savings of $2.0 million in the second half of 2020 compared to the same period in 2019

- Loss of $108.7 million ($0.19 per common share) in 2020 versus Loss of $59.2 million in 2019 ($0.11 per common share)

- Losses in 2020 and 2019 primarily attributable to net non-cash impairment charges of $117.3 million and $54.4 million, respectively, related to the Hawler license area

- Net cash generated by operating activities was $22.1 million in 2020 versus $28.1 million in 2019

- Net cash used in investing activities during 2020 was $18.8 million including payments related to drilling and facilities work in the Hawler license area and related license costs

- $13.2 million of cash and cash equivalents as of December 31, 2020

-

Total liabilities decreased by 29% to $149.0 million primarily the result of settling the Loan Agreement with AOG in full by transferring to an affiliate of AOG the Corporation’s shares of OP AGC Central Limited, the former wholly-owned subsidiary of the Corporation that holds interests in the AGC Central License Area. The loan balance (including accrued and unpaid interest) at the time of settlement amounted to $80.5 million. A $26.9 million gain was recognised on settlement of the loan

-

The transfer of OP AGC Central Limited also eliminated $30 million of minimum exploration drilling obligations

-

The reduction in liabilities was net of an $18.4 million increase in the decommissioning provision, arising primarily from amendments to the partner carry terms under the Hawler production sharing contract

2020 Operations Highlights:

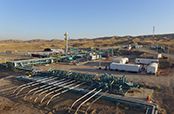

- Average gross (100%) oil production of 10,600 bbl/d (working interest 6,900 bbl/d) for the year ended December 31, 2020 versus 11,700 bbl/d (working interest 7,600 bbl/d) for the year ended December 31, 2019

- 10% decrease in gross (100%) oil production in 2020 versus 2019 primarily attributed to Banan field wells which were shut-in for three months from early April 2020 in order to optimise economics; 4% increase in gross (100%) oil production in Q4 2020 versus Q3 2020

-

Notwithstanding a difficult year resulting from the worldwide outbreak of the COVID-19 virus, which led to suspension of the Corporation’s 2020 capital expenditure program from March through September 2020, Forza Petroleum managed to maintain its operations while preserving the safety of its workforce, advanced the appraisal of the Banan field east of the Great Zab river with a sidetrack of the previously drilled Banan-1 well early in 2020, continued efforts to reduce operating expense per bbl with a workover of the Banan-4 well to replace artificial lift equipment and undertook all preparatory work necessary for a new well targeting the Tertiary reservoir of the Zey Gawra field, spudded on January 1, 2021

-

As oil prices began to recover, in July 2020, the Corporation quickly resumed production from Banan field wells that had been temporarily shut-in

-

Gross (working interest) proved plus probable oil reserves of 62 million bbl estimated by Netherland, Sewell & Associates, Inc. as at December 31, 2020

2021 Operations Update:

-

Average gross (100%) oil production of 11,600 bbl/d (working interest 7,600 bbl/d) and 11,100 bbl/d (working interest 7,200 bbl/d) in January and February 2021, respectively

- Production rates were a little down on Q4 2020, primarily as the result of reducing the rates of the Banan-5 and Banan-6 wells in the portion of the Banan field west of the Great Zab river to avoid excess production of water

-

A new well targeting the Tertiary reservoir of the Zey Gawra field, Zey Gawra-5, was completed during the first week of February 2021. The well is on production flowing 32-degree API oil at solution gas-oil ratio with no water. Production rates from the well are currently restricted but steadily being increased as facilities are being optimized to accommodate the incremental production

-

Preparations are underway to spud in April 2021 a well targeting the Cretaceous reservoir of the Banan field east of the Great Zab river, a new reservoir not yet in production. A new well pad, security infrastructure and access road have been constructed in this area where the Corporation has not yet drilled

-

For the balance of 2021, the Corporation plans to drill three further wells: one in the Zey Gawra field targeting the Cretaceous reservoir, one in the Banan field east of the Great Zab river targeting the Tertiary reservoir and a well in the Demir Dagh field targeting the Cretaceous reservoir

-

The Corporation also plans to install a gathering system to eliminate trucking in the western part of the Hawler license area to reduce environmental impact and operating expense, and undertake other facilities and maintenance activity

-

The worldwide outbreak of the COVID-19 virus, including within Iraq, has not significantly impacted operations. The Corporation is taking precautions to protect its employees and contractors but does not at this time expect that the virus outbreak will restrict operations

Liquidity Outlook:

- The Corporation expects cash on hand as of December 31, 2020 and cash receipts from net revenues from export sales exclusively through the Kurdistan Oil Export Pipeline to fund its forecasted capital expenditures and operating and administrative costs through the end of 2021, and to settle all payables currently due to suppliers. At the moment, the contingent consideration obligation is anticipated not to become payable before 2022.

CEO’s Comment

Commenting today, Forza Petroleum’s Chief Executive Officer, Vance Querio, stated:

“2020 was a transformational year for Forza Petroleum. The very significant fall in the price of oil in March 2020 led the Corporation to take immediate steps to reduce costs and to preserve capital by suspending capital expenditure, reducing head office headcount and temporarily shutting in some production in order to optimise economics. 2020 saw a change in control of the Corporation and a new name, Forza Petroleum. The Corporation was also able to settle $80.5 million in borrowings in full, and to eliminate $30 million in near-term minimum exploration drilling obligations, by transferring the Corporation’s interests in the AGC Central exploration license.

With a lean organization focused on the Hawler license area and a rebounding oil market, we are excited about the opportunity that our 2021 work program provides to increase production and to better define the remaining development potential of the four fields in the Hawler license area. The year started with the successful Zey Gawra-5 now producing from the Tertiary reservoir of the Zey Gawra field, a formation which had no oil reserves attributed to it at December 31, 2020. Later this year, we will drill the Tertiary reservoir of Banan field east of the Great Zab river. Although oil reserves were attributed to the formation at December 31, 2020, this will be our first well targeting the formation and we look forward to incremental production from the well contributing to increasing production rates during 2021. Planned completion of the Ain al Safra-2 well in the Triassic reservoir will allow us to evaluate the potential of deeper resources in a geologic region seeing increased activity in adjacent blocks.

It is noteworthy that higher oil prices since the start of the year allow us to forecast that our work program can be funded entirely from internally generated cash flow.

We look forward to implementing our plans safely in 2021 and to higher production from the Hawler license area.”

Full_Year_Results_2020.pdf